Buying a house in sunny San Diego is an exciting journey, but navigating the mortgage process can feel overwhelming. That's where a experienced San Diego mortgage broker comes in. These financial professionals are your partner throughout the entire mortgage application process, helping you secure the best possible terms for your dream home.

A skilled mortgage broker will work with you to analyze your financial situation and recommend mortgage options that match your needs and budget. They'll review rates and terms from multiple lenders, saving you the most competitive deal available.

Furthermore, a San Diego mortgage broker possesses in-depth knowledge of the local real estate market, giving them valuable knowledge to help you make informed selections. They can also guide you on important paperwork and requirements, making the entire process seamless.

In conclusion, partnering with a San Diego mortgage broker can be essential to your home buying journey. Their knowledge and commitment will help you attain your dream of owning a perfect home in the desirable city of San Diego.

Leading Mortgage Lenders in San Diego, CA

Finding the right mortgage lender for your needs in San Diego can be a challenging task. With so many alternatives available, it's essential to do your research and evaluate lenders carefully. Fortunately, we've compiled a list of highly-rated mortgage lenders in San Diego based on customer feedback, interest rates, and loan products. Whether you're a first-time homebuyer or a seasoned investor, these lenders can help you obtain the ideal mortgage for your needs.

- Lender 1: Known for its strong track record, Lender 1 is a favorite among borrowers in San Diego.

- Lender 2: With a extensive selection and customizable solutions, Lender 2 is a great alternative.

- Option C: Lender 3 offers expertise in investment properties, making it a perfect option for targeted situations.

Remember to shop around to find the mortgage that best fits your budget and goals.

Commercial Mortgage Brokerage Services 92124

Navigating the complex world of commercial real estate financing is a daunting task. Luckily for businesses in San Diego's 92124 area, there are experienced and reputable mortgage specialists ready to guide you through the process. These experts have expertise of the local market and lending landscape, enabling them to find the most competitive loan terms for your specific needs.

Whether you're looking to financing for a new construction project, an purchase, or a debt restructuring, a commercial mortgage broker can provide valuable advice. They will work closely you to evaluate your financial situation, determine the best loan options available, and facilitate the application process.

Obtain Your Commercial Property Financing: San Diego Experts

Navigating the complexities of industrial property financing can be daunting, but it doesn't have to be. With a team of seasoned finance experts at your side, you can confidently secure the funding you need to achieve your real estate goals. San Diego's dynamic market offers a wide range of choices, and our local expertise ensures you tap into the best solutions tailored to your unique needs.

- If you're acquiring a new property or optimizing an existing one, our tailored financing approaches will help you maximize your portfolio.

- Our team understand the intricacies of the San Diego commercial property market and are committed to providing you with dedicated service every step of the way.

Contact us today for a free consultation and let us help you acquire the financing you need to thrive in San Diego's competitive environment.

San Diego Mortgage Brokers: Streamlining Your Loan Process

Securing a mortgage can be daunting, especially in a vibrant market like San Diego. Thankfully, experienced financing brokers are readily available to guide you through the process. These professionals possess extensive knowledge of the lending landscape and can streamline the complexities on your behalf.

Consider a few ways San Diego mortgage brokers can make your loan journey more efficient:

- Expert Market Analysis: Brokers have their pulse on the latest market trends and interest rates, helping you obtain the most favorable terms.

- Custom Loan Solutions: They'll meticulously assess your financial situation to suggest loan options that best match your needs and goals.

- Swift Application Process: Brokers can help you prepare the necessary documentation and file your application, reducing time and effort on your part.

By working with a reputable mortgage broker in San Diego, you can enhance your chances of securing your dream home loan with assurance.

Start Your Homebuying Journey Today

San Diego's vibrant real estate market offers fantastic opportunities for homebuyers. But navigating the mortgage process can be complex. That's why it's essential to get informed about your financing options before you start house hunting.

Getting pre-approved allows you to determine exactly how much you can finance, giving you a clear check here edge in the competitive San Diego market.

- Leading mortgage providers in San Diego offer a comprehensive array of mortgage options to match your individual needs and circumstances.

- From conventional loans, to FHA loans and VA loans, you're sure to find the best-fit mortgage solution for your homeownership dreams.

Don't let financing become an obstacle in your home buying journey. Take the first step today and get pre-approved!

Alfonso Ribeiro Then & Now!

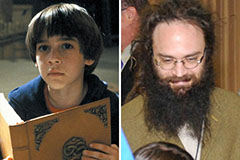

Alfonso Ribeiro Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Sydney Simpson Then & Now!

Sydney Simpson Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now!